2025 Roth Ira Contribution Limits Income - The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. Roth Magi Limit 2025 Lucy Simone, Is your income ok for a roth ira? For 2025, those modified adjusted gross income (magi) and contribution limits are:

The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

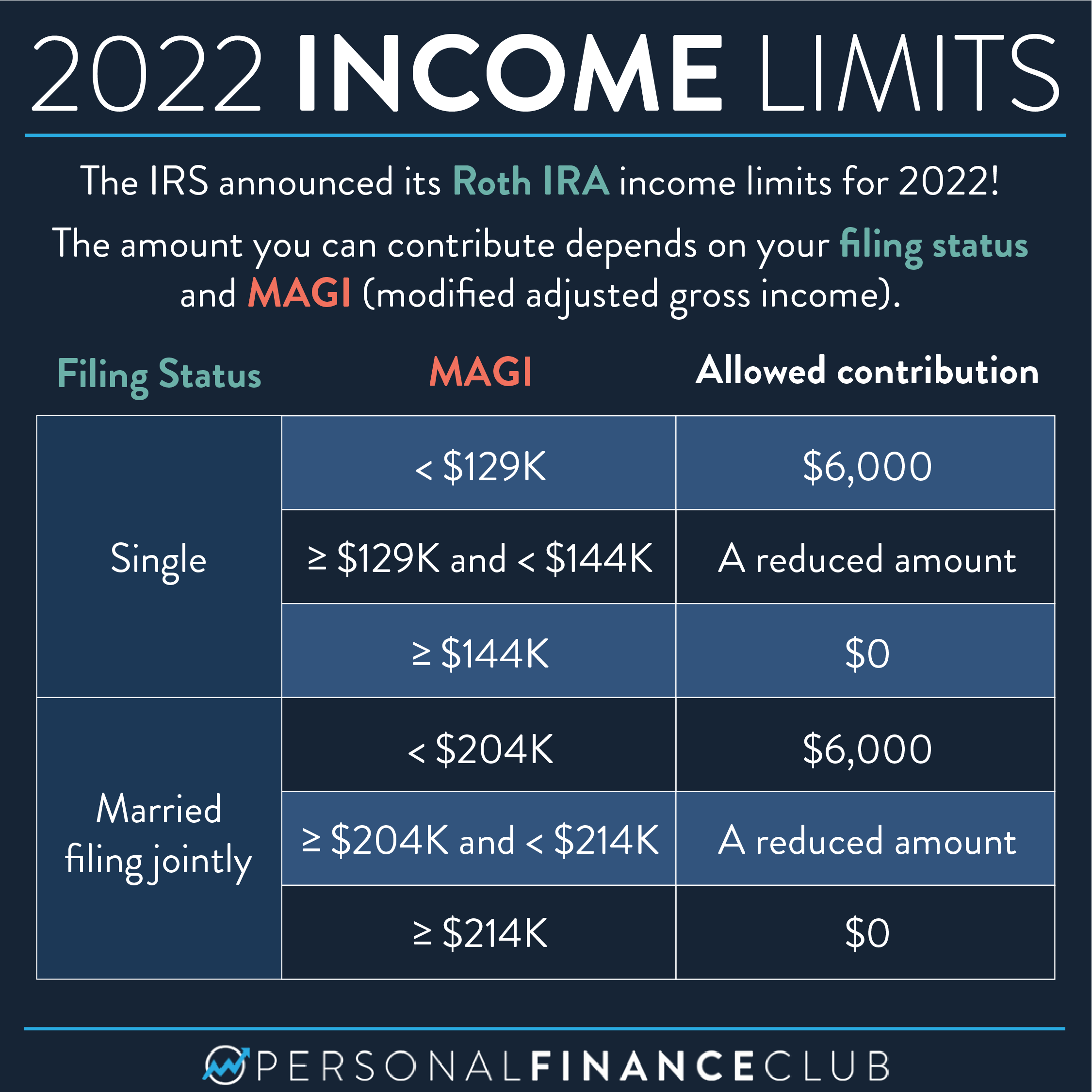

If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or more, but less than $161,000.

Mercury Retrograde 2025 Shadow Period Chart. May it allow you to find the best times […]

Is your income ok for a roth ira? It pays to be selective about what investments you choose for your roth ira because the account has annual contribution limits.

Roth Ira Limits 2025 Nissa Estella, Roth ira contribution limits are set based on your modified gross. These same limits apply to traditional iras.

New 2025 Ira Contribution Limits Phebe Brittani, *customers age 50 and older can contribute more to dcp annually. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

2025 Roth Ira Limits Joye Mahalia, And it’s also worth noting that this is a cumulative limit. As shown above, single individuals enter the partial.

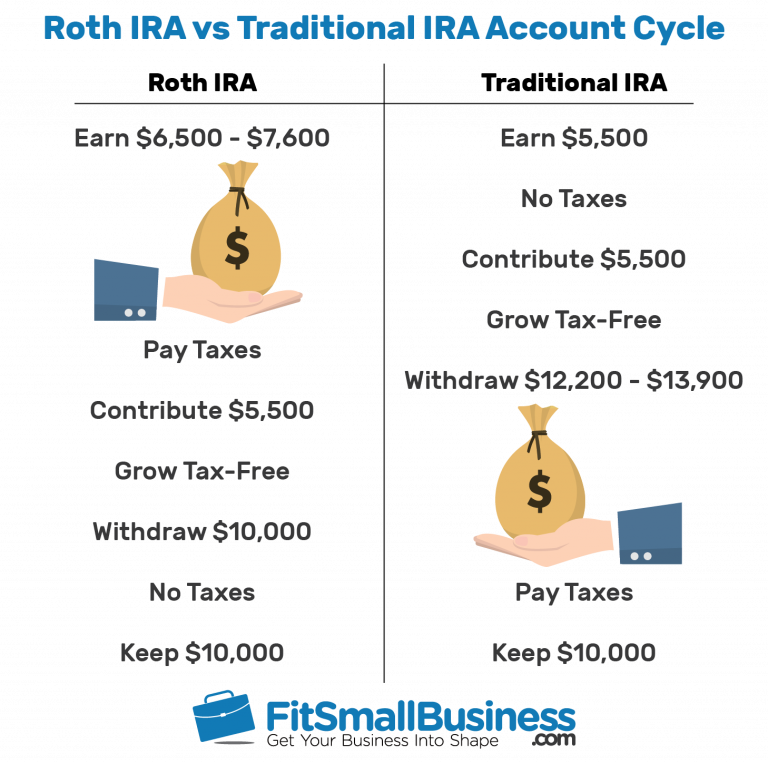

In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited based on your filing status and income.

The IRS announced its Roth IRA limits for 2025 Personal, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were. If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2025 to contribute to a roth ira, and if you’re married and filing jointly, your magi must be under $228,000 for tax year 2023 and $240,000 for tax year 2025.

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, The contribution limit shown within parentheses is relevant to individuals age 50 and older. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

2025 Roth Ira Contribution Limits Income. The roth ira contribution limit increases from $6,500 in 2023 to $7,000 in 2025. In 2025, this increases to $7,000 or $8,000 if you're age 50+.